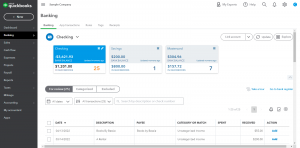

Those who are familiar with QuickBooks Online may recognize the banking screen, a frequently used feature that helps the user to input transactions. There are three main tabs under the banking screen that you will see upon entering the page. “For Review”, “Categorized” and “Excluded” help you stay organized as you make sure that amounts add up correctly from the banking feed. Each screen has a specific function that helps you get organized and stay on track from month to month.

from the banking feed. Each screen has a specific function that helps you get organized and stay on track from month to month.

The “For Review” screen gives you the option to add transactions from the bank feed into your QuickBooks online accounts. When adding a transaction, make sure to know at least the vendor’s name and to what the expense or income should be categorized. For many banks, the Banking screen picks up on vendor names from the bank detail, allowing you to quickly identify the vendor and thus the corresponding category or account. However, there may be times where the system mistakenly puts the wrong vendor or category, thus requiring extra information and verifying with either the bank statement or an invoice that matches up with the date and transaction amount. Whether or not different names match up at first, the “For Review” screen is the best tool for organizing data and information into the QuickBooks system.

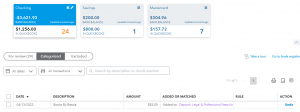

On the next screen, the “Categorized” section is where a bookkeeper will be able to review added transactions and undo them, if necessary. This tool comes in handy when mistakes are identified and thus can be quickly remedied before further problems occur. If there comes a time when the bank temporarily disconnects from the bank feed, then the bookkeeper can review which transactions have already been added, then categorize any missing transactions and exclude possible duplicates from entry to the company’s expense or income accounts. Referring to the “Categorized” section often is a way to be able to determine where recent transactions belong and which vendors are currently used.

On the next screen, the “Categorized” section is where a bookkeeper will be able to review added transactions and undo them, if necessary. This tool comes in handy when mistakes are identified and thus can be quickly remedied before further problems occur. If there comes a time when the bank temporarily disconnects from the bank feed, then the bookkeeper can review which transactions have already been added, then categorize any missing transactions and exclude possible duplicates from entry to the company’s expense or income accounts. Referring to the “Categorized” section often is a way to be able to determine where recent transactions belong and which vendors are currently used.

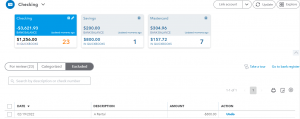

In the “Excluded” area, transactions which don’t belong or are duplicated can be intentionally left out from the company’s accounts. When used correctly, this can help by limiting the amount of errors that enter the system due to bank feed duplication or other issues. If a mistake is made when excluding a transaction, then all that is required is to identify the transaction based on date and amount, then proceed to move said transaction back to the “For Review” with a simple undo. This “Excluded” area is useful in different situations, and familiarity with this feature will help keep track of expenses that belong and remove ones which don’t.

are duplicated can be intentionally left out from the company’s accounts. When used correctly, this can help by limiting the amount of errors that enter the system due to bank feed duplication or other issues. If a mistake is made when excluding a transaction, then all that is required is to identify the transaction based on date and amount, then proceed to move said transaction back to the “For Review” with a simple undo. This “Excluded” area is useful in different situations, and familiarity with this feature will help keep track of expenses that belong and remove ones which don’t.

Available in the full version of QuickBooks Online, companies’ banks can span multiple years of transactions when importing and uploading to QuickBooks. According to a community post from QuickBooks Online, there is no upper limit to the amount of bank accounts that can be added to the QuickBooks company.

For those with further questions, feel free to reach out to JTC CPAs today and we will be more than happy to answer your questions in a consultation with one of our accounting professionals.

Disclaimer: JTC CPAs is not endorsed by or partnered with Intuit or any of its subsidiaries.

Intuit, QuickBooks, and QuickBooks ProAdvisor are registered trademarks of Intuit Inc. Used with permission under the QuickBooks ProAdvisor Agreement.